Top 5 Best REIT ETFs in 2021 to Invest in Real Estate

A real estate investment trust (REIT) is a company that owns and operates with real estate that provides income. Exchange-traded funds (ETF) are types of securities that track some kind of investment, usually index funds. Combine those two and you get REIT ETF, an instrument used for diversification or income generation in mid to long-term portfolios. Below we will list the top 5 best REIT ETFs to get exposure to the real estate market in 2021.

Why Invest in REITs?

Real Estate Investment Trusts (REITs) are great to make portfolio diversified and to get exposure to the real estate market without exposing oneself to the risk of physical possession of the real estate. There are many benefits to owning a REIT, and some of the main are:

- Efficient and effective way to get exposure to the real estate market;

- Broad exposure to real estate markets;

- Inflation protection;

- Portfolio diversification;

- Dividend based income;

- Transparency;

- Liquidity.

There are some other benefits to investing in REITs instead of physical real estate. Investors who choose REIT can invest smaller amounts of capital and diversify across continents, while for physical real estate this is not the case. In addition, REIT investments will save a ton of time. There are no worries about maintenance, management, knowledge of individual markets, or any additional maintenance costs.

The investment characteristics of real estate investment trust have provided investors with proven competitive long-term rates of return that complement the returns from other stocks and from bonds. The inclusion of REITs makes a portfolio diversified. In the past, a portfolio that had REIT investments involved has shown better returns and less volatility.

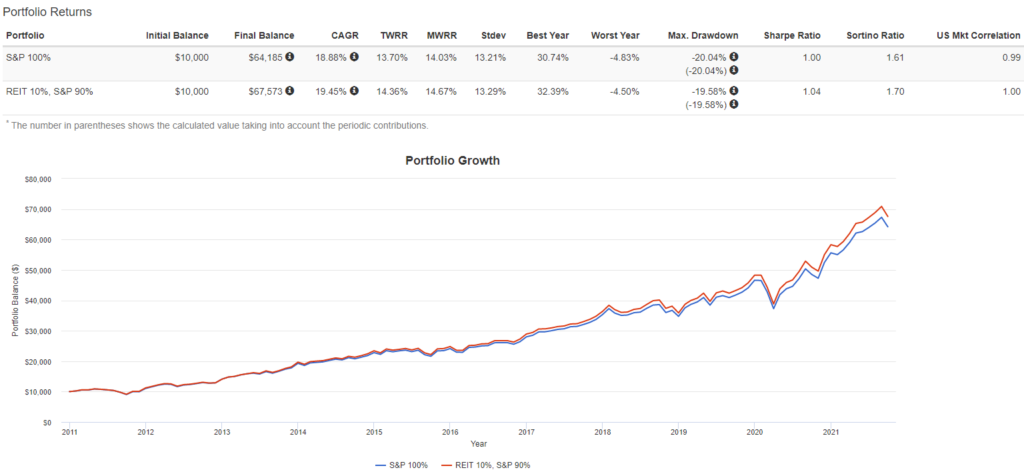

Here’s a backtest from 1985 through September 2021 comparing an S&P500 portfolio with 10% REITs versus 100% S&P500 portfolio without any allocation to REITs:

The Red line on hraph, which represents the inclusion of REIT in the portfolio, shows slightly better results – less volatile and higher returns and the overall Sharpe ratio is higher.

REITs’ tenants often sign leases for long periods of time making reliable income for investors. S&P 500 earnings, on the other hand, It can be said that REITs have less business risk than companies – they have a more stable cash flow than other companies. If there is a crisis, people will stop using some products, but they must have accommodation.

To qualify as a REIT, a company must comply with certain provisions in the Internal Revenue Code (IRC). These include generating at least 75% of gross income from rents, interest on mortgages that finance real property, or real estate sales and paying a minimum of 90% of taxable income in the form of shareholder dividends each year.

The disadvantage of REIT is that they are tax-inefficient due to their payment of 90% unqualified dividends. It would be best to hold these investments in a tax-advantaged account like a health savings account, Roth IRA, 401k, or others.

REITs own and manage a variety of property types: shopping centers, health care facilities, apartments, family homes, office buildings, hotels and others.

Now let’s see what the top 5 best REIT ETFs in 2021 are out there.

The Top 5 Best REIT ETFs in 2021

The top 5 best REIT ETFs are as follows:

Schwab US REIT ETF (SCHH)

SCHH is the cheapest ETF currently available. With an expense ratio of only 0.07%, it offers exposure to the real estate industry within the U.S. equity market. SCHH follows the Dow Jones U.S. Select REIT Index.

Currently, the fund has almost $7 billion in assets and a YTD return of 30.89%.

Vanguard Real Estate ETF (VNQ)

VNQ is the most popular ETF fund. The ETF holds over $45 billion in total assets and seeks to track the performance of the MSCI US investable market real estate 25/50 index. The fund provides a high level of income and moderates to long-term capital appreciation by providing exposure to broad U.S. market.

The fund has an expense ratio of 0.12%, an average daily volume of 4 million and a YTD return of 31.64%.

Real Estate Select Sector SPDR Fund (XLRE)

Real Estate Select Sector SPDR Fund is the most liquid ETF. The average daily volume is 6 million shares. XLRE tracks a market-cap-weighted index of REITs and real estate stocks, excluding mortgage REITs, from the S&P 500

ETF achieved a nice YTD return of 34.34% and has an expense ratio of 0.12%.

Nuveen Short-Term REIT ETF (NURE)

NURE is a top YTD performer that achieved a YTD return of 41.21%. It tracks the Dow Jones U.S. Select REIT Index. More specifically, ETF focuses on REITs with short-term lease agreements that consist of apartment buildings, hotels, self-storage facilities, and manufactured homes.

Top performing comes with a price. Therefore, Nuveen Short-Term REIT ETF has an expense ratio of 0.35% which is almost 3x of the others in this category.

Vanguard Global ex-U.S. Real Estate ETF (VNQI)

And one very good ETF for the end for all those who want to diversify beyond the United States. The Vanguard Global ex-U.S. Real Estate ETF provides exposure to international REITs outside the U.S.

The fund tracks the S&P Global ex-U.S. Property Index. The index includes approximately 425 holdings in 35 countries around the world. YTD of this ETF is 7.14% and it has expense ratio of 0.12%.