Michael Burry Recommended Reading List

If you want to read everything that Michael Burry has touched, you are not the only one. Many fans of Michael Burry keep asking about books that he reads. In this article, you will find Michael Burry recommended reading list with my reviews. Some of the links are affiliates, and I may earn a small commission when you make a purchase through them at no additional cost to you.

Warren Buffet and Shareholder’s Letters

Before we start with the books Michael Burry recommends, I want to emphasize how he often points out that in his early days he studied Warren Buffett and Warren’s letters to shareholders.

The shareholder letters are Buffett’s view on Berkshire’s annual report with a lot of humor and musings on investing thrown in. By reading Warren’s letter you will learn how to think and act like a master.

Each letter has more than 10.000 words or about 20 pages. On the website of Berkshire Hathaway, you can find letters for the last 43 years. However, if you are interested in a book that compiles the full unedited versions of each of Warren Buffett’s letters to shareholders between 1965 and 2014, you can find it on this link.

The Intelligent Investor by Benjamin Graham

I honestly think this is the best investment book ever written. And I am not the only one. Warren Buffet thinks that also. And it is first on the recommended reading list of Michael Burry.

If you want to be a good investor, this book is a must. Don’t have the money to buy it? Borrow it at your nearest library.

“The intelligent investor is a realist who sells to optimists and buys from pessimists.”

Benjamin Graham, The Intelligent Investor

You will find all sorts of quotes, and some of them will make you think and rethink. The book is not easy to read, people study it for months or even years, but when you finally understand it, a new world will open up to you – the world of investing.

Common Stocks and Uncommon Profits by Philip Fisher

Philip Fisher was a growth investor. He believed that investors should concentrate their efforts on uncovering young companies with outstanding growth prospects. That approach, he gladly lays out in this book. Very good book for all kinds of investors.

“The wise investor can profit if he can think independently of the crowd and reach the rich answer when the majority of financial opinion is leaning the other ways.”

Philip Fisher

Why Stocks Go Up And Down by William Pike

The book covers everything about stocks and bonds. It explains the basics of financial statement analysis, cash flow generation, stock price valuation, and more. Some important terms such as investment terms are explained clearly.

The coverage of the topic is encyclopedic and can fill in gaps even for experienced investors. I highly recommend this book as others on the list.

Buffettology by Buffett and Clark

Buffettology is a book that Mary Buffett, former daughter-in-law of Warren wrote together with David Clark, who studies Warren Buffet’s investment techniques to create Buffettology, a special investment guide that explains the winning strategies of the master.

The book is easy to read, well organized and logical. Thanks to clarifications from Marry Buffet which breaks sophisticated investment concepts into bite-sized chunks, and then makes those chunks easily digestible.

The New Buffettology

This is the second edition of “Buffetology”, written in 2002. Similar to the first part, the book explains in simple steps how to examine the worth of stocks. As a result, the book will guide you to find a good investment out there.

However, the book alone supports exclusively Buffet investment strategies. And that’s good, but I personally like to look at the strategies of other investors well.

Value Investing Made Easy by Janet Lowe

The author reveals in the book as the very title of the book suggests, and that is simplicity in value investing concepts. In an easy-to-understand style, combined with entertaining stories and quotes, this book will give you simple tactics that can help you achieve your investing goals.

While most business schools are teaching complex formulas and algorithms to determine if the specific investment is worth it, this book will tell you in a simple way – buy for less than intrinsic value. That’s what I like about this book. Why complicate something when it can be simple?

Security Analysis By Benjamin Graham – 1951 Edition

Michael Burry, along with the book The Intelligent Investor, also recommends the book Security Analysis by the same author, Benjamin Graham. Both books go hand in hand for those who want to learn value investing.

Although The Intelligent Investor is a better-known book, for those looking to deepen their knowledge of value investing strategies, Security Analysis is a must-read.

To be honest, this is a fat book with a lot of information to chew on, as with Graham’s other book. It’s not the easiest to understand. But once you understand, you will be at an advantage over other investors.

You may have noticed this is a 1951 version. The reason is that there are differences in newer available versions, and the current version has a lot of non-Graham-like stuff in it.

You Can Be A Stock Market Genius by Joel Greenblatt

The title of this book sounds like some kind of scam. But it’s actually a great book where you’ll learn how to profit from various special situations. The book is for intermediate to advanced investors. It explains merger securities, spinoffs, recapitalizations, bankruptcy and risk arbitrage.

Joel Greenblatt is the founder and a managing partner of Gotham Capital, a private investment partnership that has achieved an unbelievable annual return of 50% for ten years. He published the firm’s audited returns at the end of the book.

The book consists of frequent humor, making this book an interesting journey in which you will learn a lot, and also have a good laugh.

All books on the recommended reading list from Michael Burry are amazing. I think every investor should read every single one more times. The list explains why Michael Burry is such a good investor and many people follow in his footsteps.

“If you read these books thoroughly and in that order and never touch another book, you’ll have all you need to know.“

Michael Burry, 1997

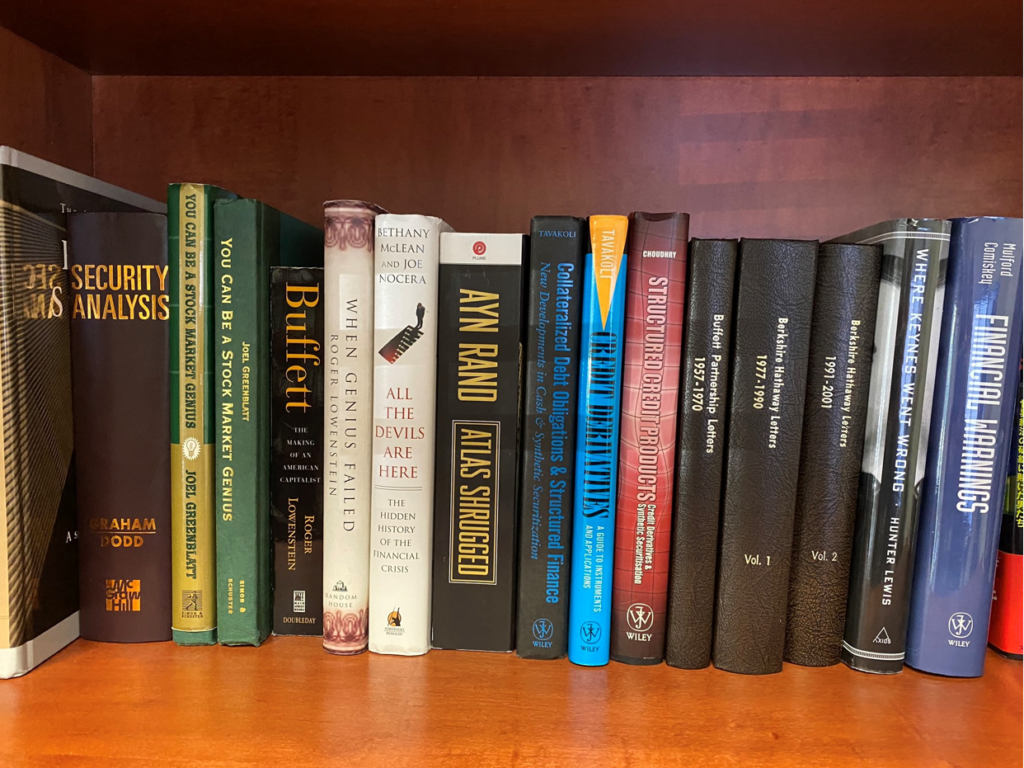

Michael Burry Office Books

There are some other books I found on Michael Burry’s photo in his office. I haven’t read them yet so I’ll just list them below without my reviews and recommendations.

Burry’s Bookshelf

Michael Burry recently (May 20, 2022) posted a twitt where he referred to a book “The Making of an American Capitalist” by Roger Lowenstein on how every investor should be unique to be successful, but he also posted his bookshelf.

Below you can find the books on Burry’s shelf that are not mentioned previously in this post:

Summary

Investing in yourself is the best investment you can make. This is something that shares the common opinion of all Superinvestors precisely because they know how valuable knowledge is.

Building your knowledge is the fastest and easiest way to improve your life and wealth.

Michael Burry knew this from early on. He spent his time learning and practicing skills in investing. Shortly after that process, he predicted the 2007 crash and made millions on the collapse of the banks.

This inspirational story is something that has caught the attention of a large number of investors, who now want to follow in his footsteps to success.